September Data Shows Mixed Economic Indicators

NMMA’s latest Monthly Recreational Boating Industry Data Summary, covering data through September 2025, shows economic pressures persisted as elevated borrowing costs and mixed household outlooks continued to influence marine market activity. Year-to-date (January–September 2025), new retail powerboat unit sales decreased 8.4% from the same period last year, with 194,338 units sold.

Segment performance varied with freshwater fishing boats and yachts seeing the least year-over-year decreases.

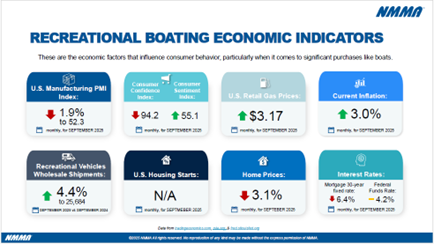

Key economic indicators offered a varied view of consumer conditions in September. The Consumer Confidence Index measured 94.2 for the month, while the Consumer Sentiment Index registered 55.1, underscoring cautious household expectations. Broader manufacturing and housing metrics showed continued shifts. The U.S. Manufacturing PMI decreased 1.9% to 52.3, indicating moderating factory activity.

On Wednesday, the Federal Reserve lowered its key interest rate by a quarter-point to a range of 3.50%–3.75%, marking its third straight reduction this year. While that move may ease borrowing costs for major purchases, the Fed signaled it expects only one additional cut in 2026, reflecting ongoing caution amid persistent inflation and a job market showing signs of softness.

As marine businesses advance operations through the remainder of the year, NMMA will continue to track these economic inputs and their relationship to consumer behavior and retail activity.

As marine businesses advance operations through the remainder of the year, NMMA will continue to track these economic inputs and their relationship to consumer behavior and retail activity.

NMMA’s Monthly Recreational Boating Industry Data Summary report is published at the beginning of each month and is available at no cost to members. The full report includes comprehensive retail and wholesale data, engine and segment breakdowns, and key economic indicators relevant to marine businesses. Associate Members can buy an annual subscription for $2,400 or a monthly copy for $250. Non-members can purchase an annual subscription for $3,500.

Visit www.nmma.org/statistics or contact [email protected] for more information. NMMA members have direct access to the NMMA Business Intelligence team to answer questions about NMMA data, insights and reporting.