Consumer Confidence Rises Slightly in July, Outlook Remains Cautious

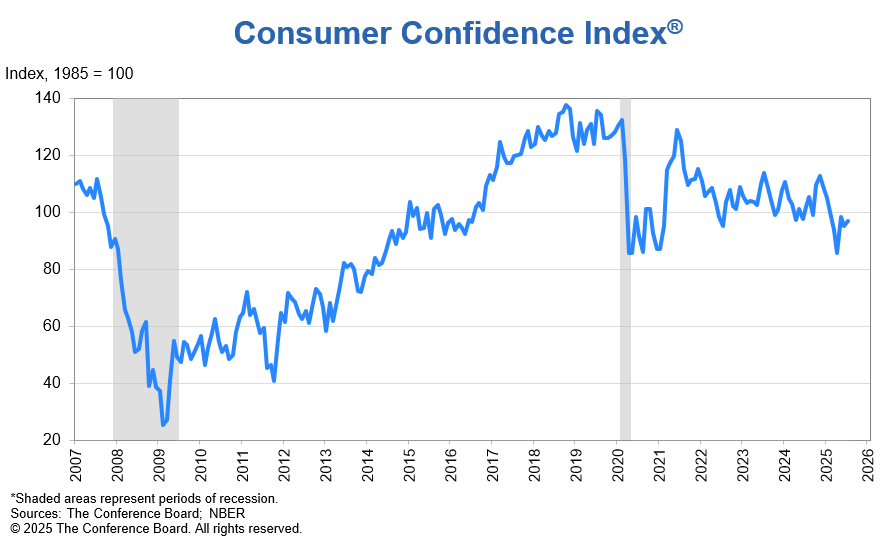

U.S. consumer confidence showed modest signs of improvement in July, according to the latest report released this week by The Conference Board. The July Consumer Confidence Index® rose marginally, signaling a slight improvement in sentiment, but continued consumer caution, heading into the latter half of the summer. The Index increased by two points to 97.2, up from 95.2 in June.

While the Expectations Index rose to 74.4, a 4.5-point gain, it remains below the 80 threshold typically linked with economic contraction, marking the sixth consecutive month in that territory. All three components of the Expectation Index improved, with consumers feeling less pessimistic about future business conditions and employment, and more optimistic about future income.

Consumers surveyed by The Conference Board indicated a more favorable outlook on the labor market. However, new government data released Tuesday showed U.S. job openings fell in June to their lowest level in more than three years, an indication the labor market may be cooling. While layoffs remain historically low, the gradual easing of job openings suggests a shift in labor market dynamics that may contribute to consumer hesitation around major spending decisions.

Additional findings from the July Consumer Confidence Index show that plans for big-ticket purchases such as homes and cars declined, with dining out remaining number one among spending intentions in services. Vacation plans were also down, with fewer Americans intending to travel domestically, though slightly more expressed interest in traveling abroad.

“The modest uptick in confidence reflects some relief in near-term sentiment, but consumer unease remains a key factor for the recreational boating industry,” said Ellen Bradley, NMMA's chief brand officer and senior vice president of marketing and communications. “According to NMMA's Q2 Marine Leadership Barometer, nearly half of industry leaders remain cautiously optimistic about the year ahead, yet concerns about softening product demand are growing. More than a third of respondents expect business conditions to decline in the short term, underscoring the importance of scenario planning and real-time market intelligence as we move through the peak season.”

This comes as the Fed announced yesterday it will keep its benchmark interest rate unchanged in the 4.25%–4.50% range, its fifth straight hold, highlighting persistent caution amid economic uncertainty and tariff-related inflation risks.

NMMA continues to monitor consumer sentiment and its implications for marine businesses. Members are encouraged to utilize resources such as the Monthly Industry Data Summary and quarterly Marine Leadership Barometer to guide decision-making and navigate evolving market dynamics.

For more economic updates and data-driven insights, visit nmma.org/statistics or contact the NMMA Business Intelligence team at [email protected].