As Consumer Confidence Rebounds in May, Mixed Economic Picture for Recreational Boating Continues

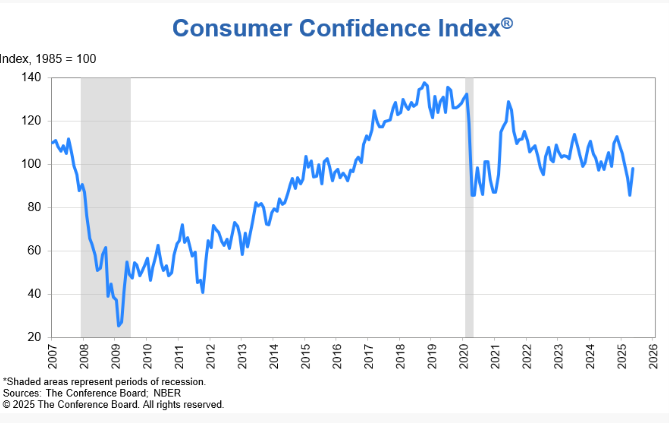

Yesterday, the Conference Board reported their Consumer Confidence Index® for May 2025, showing a rise by 12.3 points to 98.0, marking the largest monthly gain in four years and ending a five-month decline. This uptick is attributed to improved consumer expectations following eased trade tensions, notably a lessening of U.S.-China trade tensions.(The Conference Board)

Notably, the May data show a rise in the Expectations Index, suggesting consumers are more optimistic about future income and business conditions. What’s more, the report shows that compared to April, purchasing plans for homes, cars, and vacation intentions increased, with some significant gains after May 12. Plans to buy big-ticket items—including appliances and electronics—were also up.

“For recreational boating, the rebound we’re seeing for May would often be viewed as a positive signal as historically, higher consumer confidence correlates with increased spending on discretionary items like boats,” notes Ellen Bradley, NMMA Chief Brand Officer. “However, there’s been a bit of a ‘see saw’ in consumer confidence numbers amid shifting economic conditions and policies, from inflation and interest rates to the more recent tariff announcements in April and May, which have created uncertainty for marine manufacturers as well as our boating consumers, in turn making spending plans less clear.”

The Consumer Confidence report comes as the latest NMMA data shows a 9.2% decline year-over-year (22,067 units sold March 2024 compared to 20,029 March 2025) in retail sales decline across all new boat unit segments, except yacht and personal watercraft (PWC), which were up 29% and 6%, respectively.

Seeing a continued rise in consumer confidence could translate into greater interest in boating activities and purchases, however, it's important to note that while current business condition assessments improved, perceptions of job availability continued to decline for the fifth consecutive month. This indicates that while consumers feel better about the economy, concerns about employment persist and there remains a mixed picture for the broader economy and in particular, a mixed picture for recreational boat purchases, which are discretionary purchases.

As we approach the peak boating season, NMMA will continue to monitor these trends closely. Continued improvements in consumer confidence could bolster boat sales, and on the flip side, ongoing employment concerns may temper this effect. Staying attuned to these economic indicators will be crucial for members’ strategic planning in the coming months.

Stay tuned for the next installment of NMMA’s Monthly Industry Data Summary report, coming in June and in the meantime check out previous editions here. Feel free to contact the NMMA Business Intelligence and Insights Team at [email protected] with any questions.