Demand Slows as Market Watches Economic Indicators

As the U.S. recreational boating industry moved into the first quarter of 2025, new data from NMMA’s Monthly Recreational Boating Industry Data Summary report paints a complex picture—defined by ongoing retail softness, cautious optimism, and a watchful eye on economic indicators that continue to shape consumer behavior.

In the 12-month period ending February 2025, total new powerboat retail unit sales declined 7.4% year-over-year to 233,737 units. Wholesale shipments saw a steeper drop, down 13.0%, reflecting continued inventory recalibration by manufacturers and dealers alike.

Key findings from the February 2025 report include:

- While the broader trend points to a softening demand, the picture is not uniformly negative. Early 2025 year-to-date retail sales (January–February) fell a modest 4.8% compared to the same period in 2024.

- Freshwater fishing boats emerged as a bright spot—posting a 6.6% increase over last year’s start.

- Personal watercraft (PWC) sales were nearly flat year-over-year (+0.1%), demonstrating resilience in more accessible, lower-cost segments.

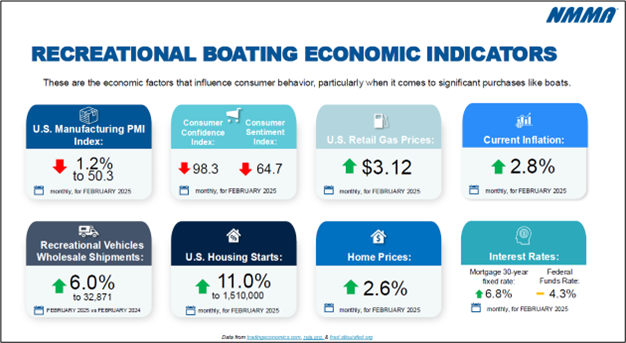

February’s macroeconomic backdrop added context to this environment. The Consumer Confidence Index hovered at 98.3 and the Consumer Sentiment Index remained low at 64.7, both indicative of cautious consumer behavior. Inflation eased slightly to 2.8%, but the 30-year fixed mortgage rate held firm at 6.8%, and the federal funds rate remained at 4.3%—continuing to put a brake on interest-sensitive, discretionary purchases like boats. However, unemployment remained healthy, contributing to the mixed economic picture.

“The early part of 2025 continues to show the effects of a cautious consumer facing inflationary pressures, however, the job market remained relatively healthy, and we were seeing signs of a return to growth in February, ahead of the early April “Liberation Day”, tariff announcements ,” said Ellen Bradley, NMMA’s chief brand officer. “ With the mixed category sales and macroeconomic picture year to date, consumers and industry alike probably found themselves in a bit of “watch and wait” mode Still, demand for wellness-driven, outdoor experiences remains strong and as consumers prioritize time with family, nature and their well-being, boating continues to offer unmatched opportunity that can be a strategic advantage to lean into, with everything from marketing to new product innovation to customer engagement.”

NMMA’s Monthly Recreational Boating Industry Data Summary report is published at the beginning of each month and is available at no cost to members. The full report includes comprehensive retail and wholesale data, engine and segment breakdowns, and key economic indicators relevant to marine businesses.

NMMA’s Monthly Recreational Boating Industry Data Summary report is available at no cost for members. Associate members can purchase an annual subscription for $1,800.

Download the latest report here

Bookmark https://www.nmma.org/statistics/publications/industry-data-summary for direct and easy access. Visit www.nmma.org/statistics or contact [email protected] for more information.

Download the latest report here

Bookmark https://www.nmma.org/statistics/publications/industry-data-summary for direct and easy access. Visit www.nmma.org/statistics or contact [email protected] for more information.